Re-examining Wage share in the US (1959-2024)

Wednesday, September 22, 2021

Re-examining Wage share in the US (1959-2024)

Friday, September 17, 2021

Comments on Position Limits in Commodity Markets

Comments on Position Limits in Commodity Markets

quoted in Federal Registry

...and that allowing owners of more than 10 percent of another entity not to

aggregate could ‘‘potentially spark additional ‘herd-like’ behavior, thus

causing another commodities futures boom-bust cycle.’’

- International Association of Machinists and Aerospace Workers on June 29, 2012 (‘‘CL– IAMAW’’).

Summary

COMMODITY FUTURES TRADING COMMISSION 17 CFR Part 151 ruN: 3038-AD82 AGGREGATION UNDER PART 151, POSITION LIMITS FOR FUTURES AND SWAPS.

The proposed rule would

amend the rules establishing speculative position limits for physical commodity

futures and option contracts traded on a designated contract market and

economically equivalent swaps, which were published in the Federal Register on

November 18, 2011.

The proposed rules would permit any market

participant with an ownership interest of 10% up to 50% in a separately

organized entity (an "owned entity") to make a notice filing of

exemption from aggregation by demonstrating independence in decision making.

The owned entity could be a financial or a nonfinancial entity that has passive

ownership interests.

By

loosening the ownership of interest up to 50%, the proposed rule can potentially spark additional “herd-like”

behavior, thus causing another commodities futures boom-bust cycle. We believe that without strong regulations including position limits established

by the Dodd Frank Act, excessive speculation in the futures markets will

continue. Therefore, we recommend that Commodities Futures Trading Commission (CFTC) adhere to its

existing formula of setting position limits such that no single

investor can constitute more than 10 percent of a market, as measured by open

interest, up to 25,000 contracts of open interest, and 2.5 percent thereafter. However, if CFTC’s existing position limit

formula is considered not to be feasible, then we suggest CFTC give Pollin and

Heintz (2011) and CME group (2011) position limits proposals serious

consideration.[1]

Our views are based on the analysis of the

empirical literature on position limits, excessive speculation, price

volatility and the financialization of commodities.[2]

The literature reviewed shows that institutional investors in its attempts find

“safe havens” and increase their profits entered into the commodity markets en

masse. As a result, prices became

inflated beyond the fundamentals of supply and demand (boom) and subsequent drop

in prices when many institutional investors exited the commodities market

(bust).

With the increasing presence of

institutional investors in the commodities market, it appears that index

traders (institutional investors) primarily hold long positions (buyers). Several economists show that from a sheer

size perspective the number of index traders tend to be small, however, “their

average long positions is very large…sometimes more than 10 times the size of

an average long positions held by either commercial or non-commercial traders. A

direct consequence is that index traders can have strong financial power to

influence prices. As a result, speculative bubbles may form and price changes

can no longer be interpreted as reflecting fundamental supply and demand signals”

(Mayer 2009).

A policy response to guard against

excessive speculation is for the CFTC “to exercise its

authority to ensure that the policy tools provided by Dodd-Frank are

implemented in ways that protect the interests of ordinary people and small businesses

throughout the United States (Pollin and Heintz 2011:5). Specifically, Section 737 of the Dodd Frank Act mandates that

CFTC institute position limits in order

to “diminish, eliminate, or prevent excessive speculation.” Thus, from the existing studies, reports and

articles cited, it is clear that position limits are needed in the commodities

market.[3]

As mentioned previously, we believe that the existing rules are reasonable and sound. The proposed rule as written deviates from

the intended purpose as instructed in the Dodd Frank Act. Although

not a panacea to end all excessive speculation, position limits can be another

tool in the tool box.

[1] Pollin

and Heintz (2011) and CME Group (2011)

[2]

See our analyses in Appendix A.

[3]

See Appendix B.

Wednesday, September 15, 2021

Examining Work Stoppages in a Modified Goodwin Business Cycle Model

Themes and Issues in Labor and Labor Unions

Summary

• Until

recently, there was a general consensus that the number of work stoppages

(strikes and lockouts) is cyclical. Aside from a few incidents, “noise”, it was

shown empirically that the number of strikes tend to increase during economic expansion

but decline during a contraction.

• Most

believe this pro cyclical relationship was a “stylized’ economic fact, at least

up to the end of what is considered the “golden age” of capitalism (1948 –

1980). Further, research indicate that

trends in strike activity and union membership were more instrumental for

impacting labor's share during the peak period of the capital–labor accord

(golden age) and less instrumental in later period post 1981(neoliberal

period).

Monday, September 13, 2021

Strategic Competition, Dynamics and the Role of the State: A New Perspective, by Jamee K. Moudud - A Book Review byTazewell V Hurst III

Hurst, T. Strategic Competition, Dynamics and the Role of the State: A New Perspective, by Jamee K. Moudud. Eastern Econ J 39, 260–263 (2013). https://doi.org/10.1057/eej.2011.30

Moudud's Book Review (uncorrected proof)

Strategic Competition, Dynamics and the Role of the State: A New Perspective. By Jamee K. Moudud. Edward Elgar, Cheltenham, UK, 2010. 167pp., $99.00. ISBN: 978-1-845-42923-2.

Strategic Competition, Dynamics and the Role of the State attempts to provide a “more robust foundation for heterodox economic theory and policy.” Jamee Moudud believes his book makes two contributions. “First, it has provided a new interpretation of the microeconomics of OERG (Oxford Economists’ Research Group) . Second, the nature of fiscal policy to raise the warranted growth rate has been elaborated” [p. 136].

Wednesday, September 8, 2021

The Recession is over for all workers in the manufacturing sector but at different points in time

The Sahm Rule identifies signals related to the start of a recession when the three-month moving average of unemployment rate rises at a minimum 0.50 percentage points or more relative to its low during the previous 12 months.

Sahm Rule Manufacturing

Sahm Food Manufacturing

Tuesday, September 7, 2021

The September Jobs Report Misses Employment Forecasts, Unemployment down to 5.2%.

The United States (U.S.) economy added 235,000 jobs in August of 2021, the lowest in seven months and well below forecasts of 750,000 as a surge in COVID-19 infections may have discouraged companies from hiring and workers from actively looking for a job.

Most jobs were created in professional and

business services (+74,000), transportation and warehousing (+53,000), private

education (+40,000), manufacturing with most of them coming in motor vehicles despite ongoing

struggles to source parts, and other services (+37,000).

Employment in retail trade declined over the month (-29,000) mostly because of

food and beverage stores (-23,000) and building material and garden supply

stores (-13,000). Employment in leisure and hospitality was unchanged.

Source: Analysis U.S. Department of Labor and Wells Fargo Securities

Overall, nonfarm employment has risen by 17

million since April 2020 but is down by -5.3 million, or 3.5%, from its

pre-pandemic level in February 2020.

The standard, headline unemployment rate (U-3)

dropped to 5.2 percent in August 2021, the lowest level since March 2020 and in

line with market expectations, as the labor market continued its steady

recovery following business re-openings in the US and despite reports of labor

supply shortages and concerns over the lingering threat of the COVID-19

resurgence. The number of unemployed people fell by 318,000to 8.38 million,

while employment levels increased by 509,000 to 153.15 million. The broad or real unemployment rate (U-6) is at 8.90%, compared to 9.60% last

month and 14.30% last year. This is lower than the long term average of 10.44%.

Headline and Real

Unemployment Rates

Although the jobless rate remained well above

the pre-crisis level of about 3.5 percent, experts believe that the rate should

decline further due to strong economic activity and demand for labor

As indicated, the Delta surge is holding down

job growth in the leisure & hospitality sector. After increasing by more

than 300K for four straight months, employment growth was stagnant in August.

Unemployment Intensity is the product of the duration and the rate of unemployment. The unemployment intensity is constructed

by multiplying the unemployment rate for an index representing the average

duration of unemployment, with the idea that unemployment becomes more intense when

its duration increases. As shown below

unemployment intensity has increased since the end of the COVID-19 recession

but appears to have leveled out and possibly shifting downward.

Wednesday, September 1, 2021

Employment Summary August 2021 Jobs Report for the United States

Employment Summary August 2021

Jobs Report for the United States

United States – Department of Labor August Jobs Report

According to the United States Department of Labor August Jobs Report, the unemployment rate decreased by 0.5 percentage points from the previous month to 5.4 percent which was below the forecast of 5.7 percent July unemployment rate. The rise can be attributed to more people returning to work which is a sign that the labor market is beginning to recover from the short but deep recession.

The National Bureau of Economic Research (NBER) Business Dating Committee determined that the COVID-19 recession lasted just two months (from February 2020 to April 2020), which would makes it the shortest US recession on record. Despite the fact that the COVID recession is deemed over, it is important to note that the unemployment rate is still well above the pre-pandemic level of 3.9 percent.

The restoration of 978,000 (the highest number jobs in the prior ten months) jobs is significant and beat the employment forecast of 950,000 for the month of July. The three month moving average for July is approximately 832, 000 jobs restored. Nonfarm payroll employment in July was up by 16.7 million since April 2020 but it is still down by 5.7 million compared to its pre-pandemic level in February 2020

The Economic Policy Institute (EPI) states that, the unemployment rate fell for the right reasons in July as more people found work rather than left the labor force. They predict that the current pace of job restoration/growth (as a result of lifting of more COVID-19 restrictions) will lower the unemployment rate to pre-pandemic levels (4 percent or lower) by July 2022 with a full recovery by the end of 2022 – a recovery five times as fast as the recovery following the Great Recession. Other analysts believe that a full recovery can occur as early as February 2022.

Similar to the July Jobs Report, notable job gains occurred in leisure and hospitality with an increase of +380,000 and food services and drinking places (+253,000). The Employment Situation , July2021 report also points to job gains in local government (+221,000). Employment also continued to increase in accommodation (+74,000) and in arts, entertainment, and recreation (+53,000). Despite recent growth, employment in leisure and hospitality is down by 1.7 million, or 10.3 percent, from its level in February 2020.

Industries impacting the industrial unions show a slight net employment increase from the previous month in in transportation and warehousing (+50,000 for all employees)). Specifically, employment gains where in transit and ground passenger transportation (+19,000), warehousing and storage (+11,000). The good news in this industry is that employment has grown by 534,000 since April 2020, a 92.9 percent recovery from of the jobs lost during the February-April 2020 recession (-575,000).

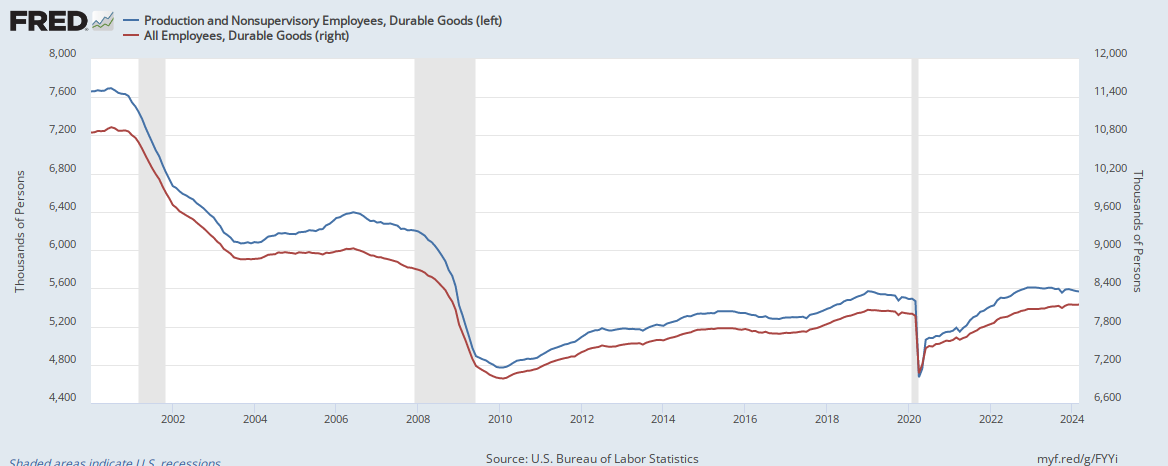

Employment in manufacturing increased by 27,000 in July, largely in durable goods manufacturing (+20,000). Within durable goods, job gains occurred in machinery (+7,000) and miscellaneous durable goods manufacturing (+6,000). Overall, manufacturing employment is well short (-433,000) of its February 2020 level.

Manufacturing Employment

Month to Month change in Manufacturing Employment

Job gains in durable goods such as fabricated metal products (+4,500 for all employees and +3,800 for production and nonsupervisory workers), and primary metals (+2,500 for all employees and +3,700 for production and nonsupervisory workers) Nonmetallic metals saw increases by 1,800 employees and 300 production and nonsupervisory workers. Other durable goods manufacturing sectors pertinent to industrial unions include transportation equipment (-1.500 all employees and +2,000 production and nonsupervisory workers), computer and electronic products (-500 all employees and 2,400 production and nonsupervisory workers), electrical equipment and appliances (+200 all employees, and production and nonsupervisory workers, respectively), transportation equipment (-1,500 all employees and +2,000 production and nonsupervisory workers).

Durable Goods Employment

Month to Month Change in Durable Goods

Nondurable goods producers gained +7,000 jobs for all employees and for production and nonsupervisory employees, respectively

Nondurable Manufacturing

Month to Month Change in Nondurable Employment

Within the nondurables sectors employment gains/losses were mixed. For instance, employment in food manufacturing increased by 4,000 for all employees and by 3,600 production and nonsupervisory workers. Overall employees in chemical manufacturing saw growth of all workers by +2,600 while the number of production and nonsupervisory workers saw a decrease by -1,800 jobs The number of jobs increased in rubber and plastics (+300, and +1,600 production and nonsupervisory employees) and, Petroleum and coal products employees continue to see a month over month decrease by -.400 employees and-1,600 for production and nonsupervisory workers).

Most economists and analysts believe that the August 2021 Employment Situation report is a good indicator that the economy is heading in the right direction. According to Dean Barker of CEPR, the “Delta variant had not had a major impact on the labor market, at least through the middle of July. If its spread can be contained we will likely continue to see strong job growth, coupled with declines in unemployment”.

Revisiting the Wage Phillips Curve in the Three Economic Periods from 1960 -2022

Abstract This paper will examine the economic period from 1960 to 2022, which captures the role of monetary policies impact of the Phill...

-

Re-examining Wage share in the US (1959-2024) Figure show the compensation of employees as a share of personal income. Updating the post by...